Analyzing B3 Index Data

Source:vignettes/Fetching-historical-index-data.Rmd

Fetching-historical-index-data.RmdIntroduction

The B3 (Brasil, Bolsa, Balcão) provides comprehensive data for its market indices through various endpoints. These indices represent essential benchmarks for the Brazilian financial market, measuring the performance of different market segments.

The rb3 package simplifies access to this data through

four key templates:

-

b3-indexes-historical-data: Historical performance data for B3 indices -

b3-indexes-composition: Composition of all B3 indices showing which stocks belong to each index -

b3-indexes-theoretical-portfolio: Theoretical portfolio weights for indices with detailed component weights -

b3-indexes-current-portfolio: Current actual portfolio with additional sector classification information

This vignette demonstrates how to retrieve, analyze, and visualize

index data using the rb3 package, featuring examples for

the most popular indices like Ibovespa (IBOV), Small Caps (SMLL), and

Dividend Index (IDIV).

Retrieving available indices

The rb3 package provides a function to retrieve all

available indices from B3:

# Get all available indices

indexes <- indexes_get()

head(indexes)#> [1] "AGFS" "BDRX" "GPTW" "IBBR" "IBEE" "IBEP"These codes represent the various indices calculated and published by B3. Some of the most important ones include:

- IBOV: Ibovespa - the main Brazilian stock market index

- SMLL: Small Caps Index - represents smaller market capitalization stocks

- IDIV: Dividend Index - tracks stocks with the best dividend payment policy

- IBXX: IBrX-100 - represents the 100 most traded stocks

- IBXL: IBrX-50 - represents the 50 most traded stocks

- IBRA: Brazil Broad-Based Index - broader market index

Fetching historical index data

To analyze the historical performance of indices, you can use the

b3-indexes-historical-data template:

# Download historical data for specific indices across multiple years

fetch_marketdata("b3-indexes-historical-data",

throttle = TRUE,

index = c("IBOV", "SMLL", "IDIV"),

year = 2018:2023

)After downloading, you can retrieve and analyze the data:

# Get the historical data for analysis

index_history <- indexes_historical_data_get() |>

filter(

symbol %in% c("IBOV", "SMLL", "IDIV"),

refdate >= "2018-01-01"

) |>

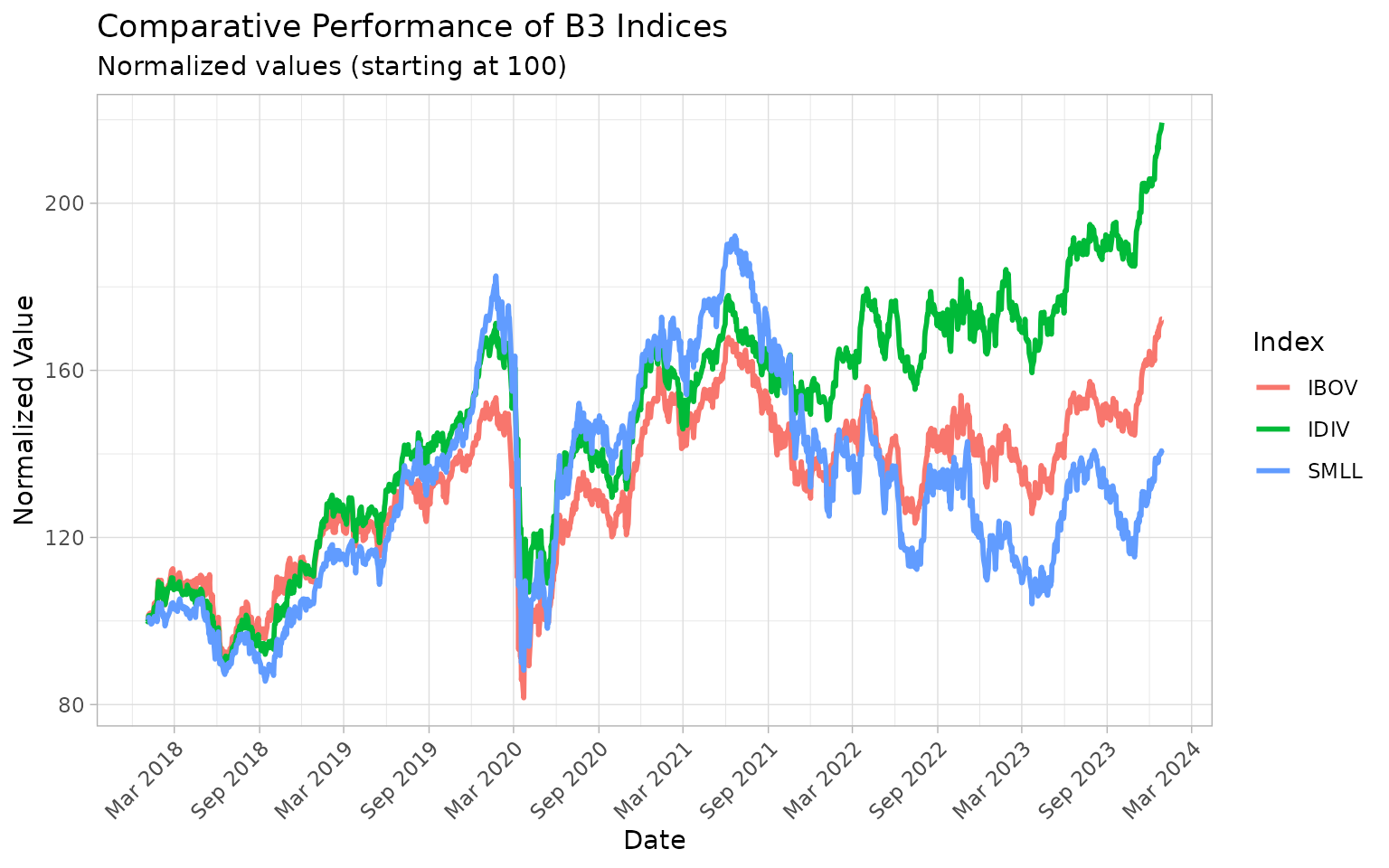

collect()Visualizing index performance

Let’s compare the performance of multiple indices over time:

# Calculate the normalized performance (setting the starting point to 100)

index_performance <- index_history |>

group_by(symbol) |>

arrange(refdate) |>

mutate(

norm_value = value / first(value) * 100

)

# Create the performance chart

ggplot(index_performance, aes(x = refdate, y = norm_value, color = symbol)) +

geom_line(linewidth = 1) +

labs(

title = "Comparative Performance of B3 Indices",

subtitle = "Normalized values (starting at 100)",

x = "Date",

y = "Normalized Value",

color = "Index"

) +

theme_light() +

scale_x_date(date_labels = "%b %Y", date_breaks = "6 months") +

theme(axis.text.x = element_text(angle = 45, hjust = 1))

Historical Performance of B3 Indices (2018-2023)

This chart shows the relative performance of the selected indices, allowing you to compare their movements regardless of their absolute values.

Analyzing index composition

The b3-indexes-composition template provides data about

which stocks belong to each index:

# Download index composition data

fetch_marketdata("b3-indexes-composition")After downloading, you can retrieve the composition data:

# Get the composition data

composition <- indexes_composition_get() |>

collect()

# Display a subset of the composition data

head(composition)

#> # A tibble: 6 × 3

#> update_date symbol indexes

#> <date> <chr> <chr>

#> 1 2025-04-14 TTEN3 AGFS,IBRA,ICO2,ICON,IGCT,IGCX,IGNM,ITAG,SMLL

#> 2 2025-04-14 ABBV34 BDRX

#> 3 2025-04-14 ABCB4 IBRA,ICO2,IDIV,IFNC,IGCT,IGCX,ITAG,SMLL

#> 4 2025-04-14 ADBE34 BDRX

#> 5 2025-04-14 A1AP34 BDRX

#> 6 2025-04-14 A1MD34 BDRXFinding stocks in multiple indices

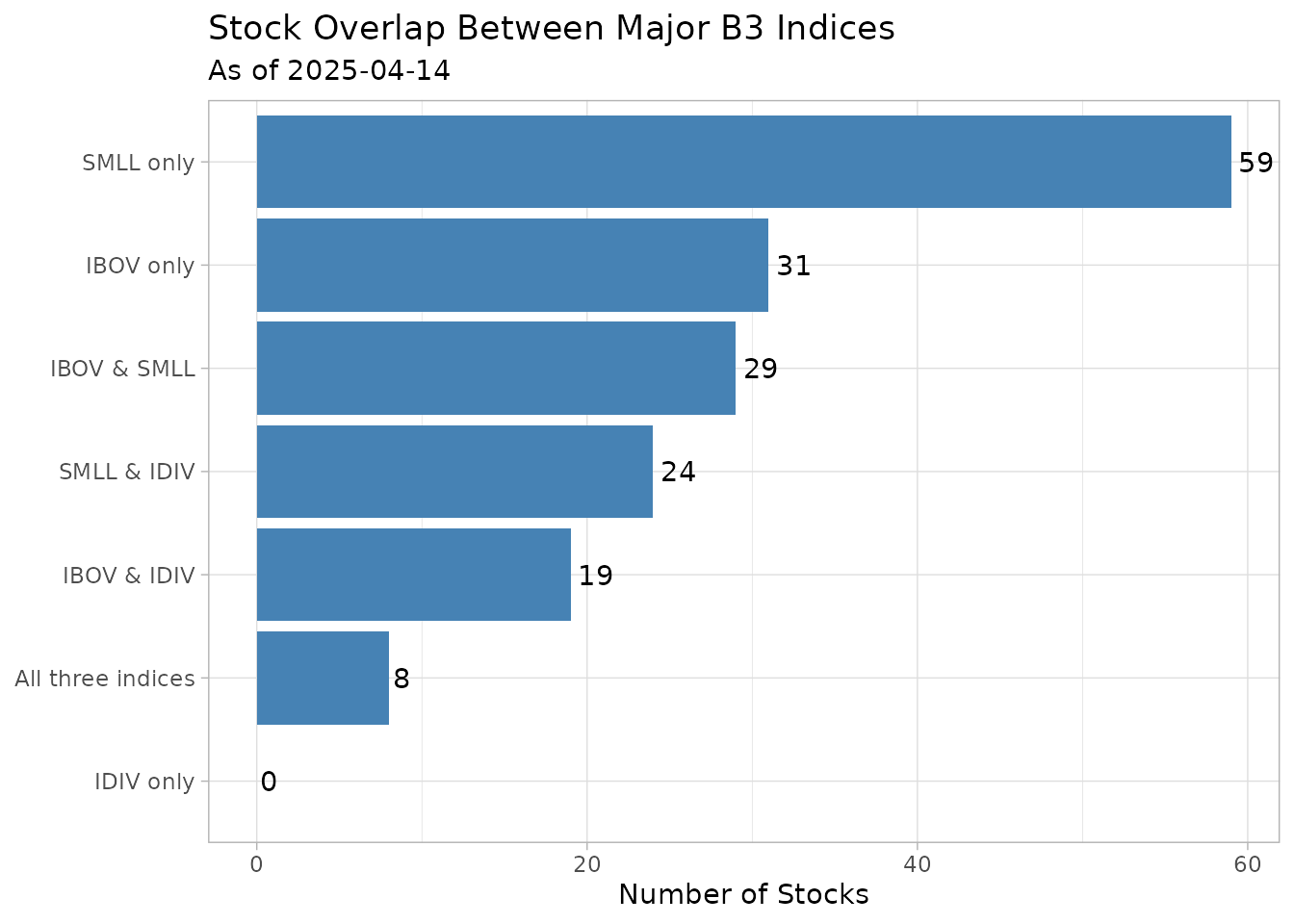

You can analyze which stocks appear in multiple key indices:

# Get stocks in specific indices

selected_indices <- c("IBOV", "SMLL", "IDIV")

# Find stocks in each index

stocks_by_index <- lapply(selected_indices, function(idx) {

composition |>

filter(update_date == latest_date, str_detect(indexes, idx)) |>

pull(symbol)

})

names(stocks_by_index) <- selected_indices

# Create a data frame for the Venn diagram visualization

index_overlaps <- data.frame(

Index = c(

"IBOV only", "SMLL only", "IDIV only",

"IBOV & SMLL", "IBOV & IDIV", "SMLL & IDIV",

"All three indices"

),

Count = c(

length(setdiff(setdiff(stocks_by_index$IBOV, stocks_by_index$SMLL), stocks_by_index$IDIV)),

length(setdiff(setdiff(stocks_by_index$SMLL, stocks_by_index$IBOV), stocks_by_index$IDIV)),

length(setdiff(setdiff(stocks_by_index$IDIV, stocks_by_index$IBOV), stocks_by_index$SMLL)),

length(intersect(setdiff(stocks_by_index$IBOV, stocks_by_index$IDIV), stocks_by_index$SMLL)),

length(intersect(setdiff(stocks_by_index$IBOV, stocks_by_index$SMLL), stocks_by_index$IDIV)),

length(intersect(setdiff(stocks_by_index$SMLL, stocks_by_index$IBOV), stocks_by_index$IDIV)),

length(Reduce(intersect, stocks_by_index))

)

)

# Create a bar chart to visualize overlaps

ggplot(index_overlaps, aes(x = reorder(Index, Count), y = Count)) +

geom_bar(stat = "identity", fill = "steelblue") +

coord_flip() +

labs(

title = "Stock Overlap Between Major B3 Indices",

subtitle = paste("As of", latest_date),

x = NULL,

y = "Number of Stocks"

) +

theme_light() +

geom_text(aes(label = Count), hjust = -0.2)

Overlapping Stocks Between Major B3 Indices

Finding which indices contain a specific stock

You can also determine which indices include a specific stock:

# Find all indices that include a specific stock

find_indices_for_stock <- function(stock_symbol, comp_data, date) {

comp_data |>

filter(update_date == date, symbol == stock_symbol) |>

pull(indexes) |>

str_split(",") |>

unlist() |>

sort()

}

# Example: Find indices containing PETR4

petr4_indices <- find_indices_for_stock("PETR4", composition, latest_date)#> [1] "IBBR" "IBEE" "IBEW" "IBLV" "IBOV" "IBRA" "IBSD" "IBXL" "IBXX" "IDIV"

#> [11] "IDVR" "IGCT" "IGCX" "ITAG" "MLCX"Analyzing index weights with the theoretical portfolio

The b3-indexes-theoretical-portfolio template provides

information about the weights of stocks in each index:

# Download theoretical portfolio data

fetch_marketdata("b3-indexes-theoretical-portfolio", index = c("IBOV", "SMLL", "IDIV"))After downloading, you can retrieve and analyze the portfolio weights:

# Get the theoretical portfolio data

theoretical <- indexes_theoretical_portfolio_get() |>

collect()

# Get the latest date for each index

latest_dates <- theoretical |>

group_by(index) |>

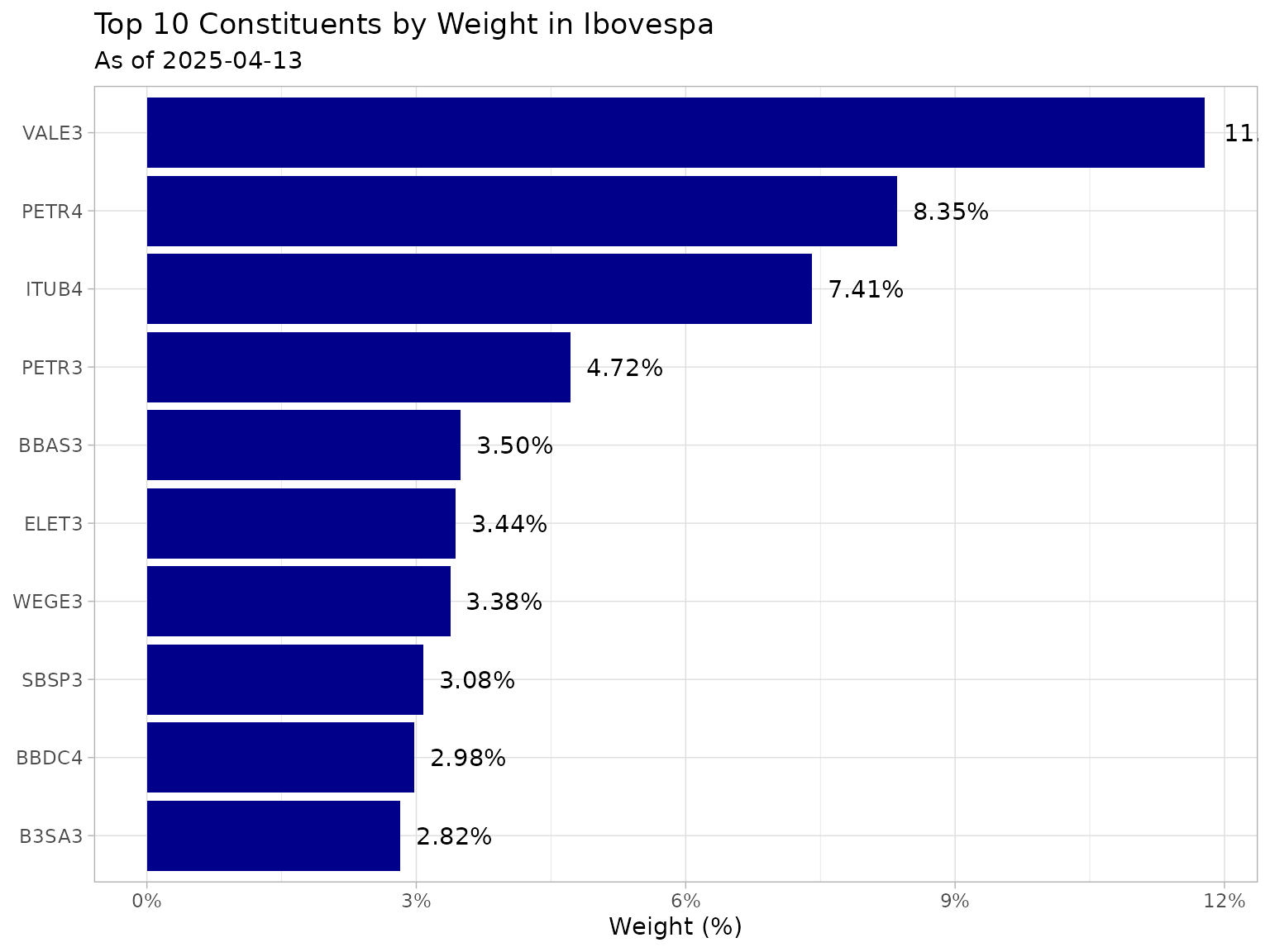

summarise(latest = max(refdate))Top constituents by weight

You can analyze the top constituents of an index by weight:

# Get the top 10 constituents by weight for IBOV

ibov_top10 <- theoretical |>

filter(index == "IBOV", refdate == latest_dates$latest[latest_dates$index == "IBOV"]) |>

arrange(desc(weight)) |>

slice_head(n = 10)

# Create a bar chart of top constituents

ggplot(ibov_top10, aes(x = reorder(symbol, weight), y = weight)) +

geom_bar(stat = "identity", fill = "darkblue") +

coord_flip() +

labs(

title = "Top 10 Constituents by Weight in Ibovespa",

subtitle = paste("As of", latest_dates$latest[latest_dates$index == "IBOV"]),

x = NULL,

y = "Weight (%)"

) +

theme_light() +

scale_y_continuous(labels = scales::percent) +

geom_text(aes(label = scales::percent(weight, accuracy = 0.01)), hjust = -0.2)

Top 10 Constituents by Weight in Ibovespa

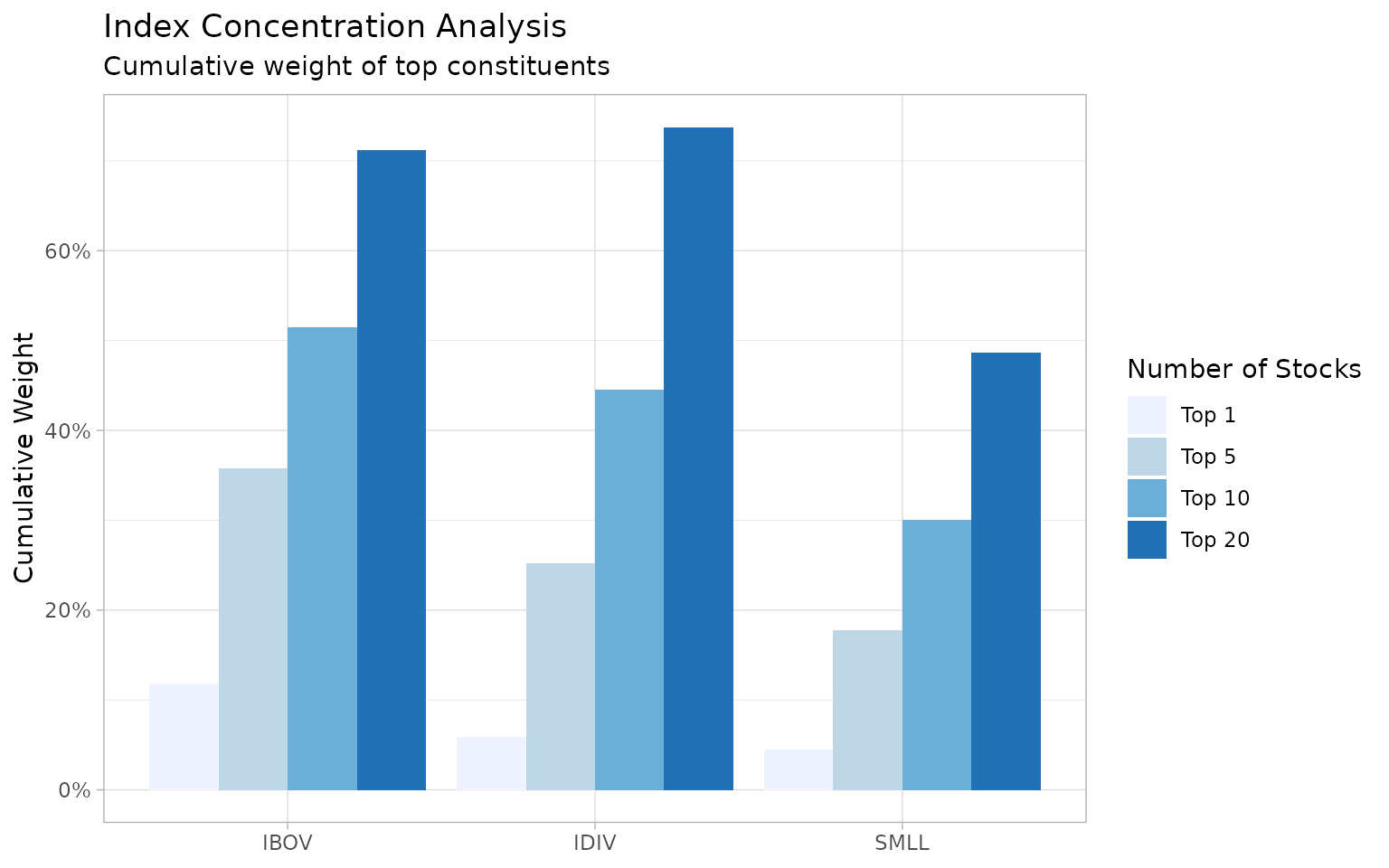

Comparing index concentration

You can compare the concentration of different indices by analyzing their weight distribution:

# Calculate cumulative weights for different indices

concentration_data <- list()

for (idx in c("IBOV", "SMLL", "IDIV")) {

latest <- latest_dates$latest[latest_dates$index == idx]

index_weights <- theoretical |>

filter(index == idx, refdate == latest) |>

arrange(desc(weight))

total_stocks <- nrow(index_weights)

concentration_data[[idx]] <- data.frame(

index = idx,

top_n = c(1, 5, 10, 20, total_stocks),

cum_weight = c(

sum(index_weights$weight[1:1]),

sum(index_weights$weight[1:5]),

sum(index_weights$weight[1:10]),

sum(index_weights$weight[1:20]),

sum(index_weights$weight)

)

)

}

concentration_df <- bind_rows(concentration_data)

# Create a grouped bar chart

concentration_plot <- concentration_df |>

filter(top_n %in% c(1, 5, 10, 20)) |>

mutate(top_n_label = paste("Top", top_n))

ggplot(concentration_plot, aes(x = index, y = cum_weight, fill = factor(top_n))) +

geom_bar(stat = "identity", position = "dodge") +

labs(

title = "Index Concentration Analysis",

subtitle = "Cumulative weight of top constituents",

x = NULL,

y = "Cumulative Weight",

fill = "Number of Stocks"

) +

theme_light() +

scale_y_continuous(labels = scales::percent) +

scale_fill_brewer(palette = "Blues", labels = c("Top 1", "Top 5", "Top 10", "Top 20"))

Weight Concentration in B3 Indices

This chart shows how concentrated each index is, revealing differences in their construction methodology.

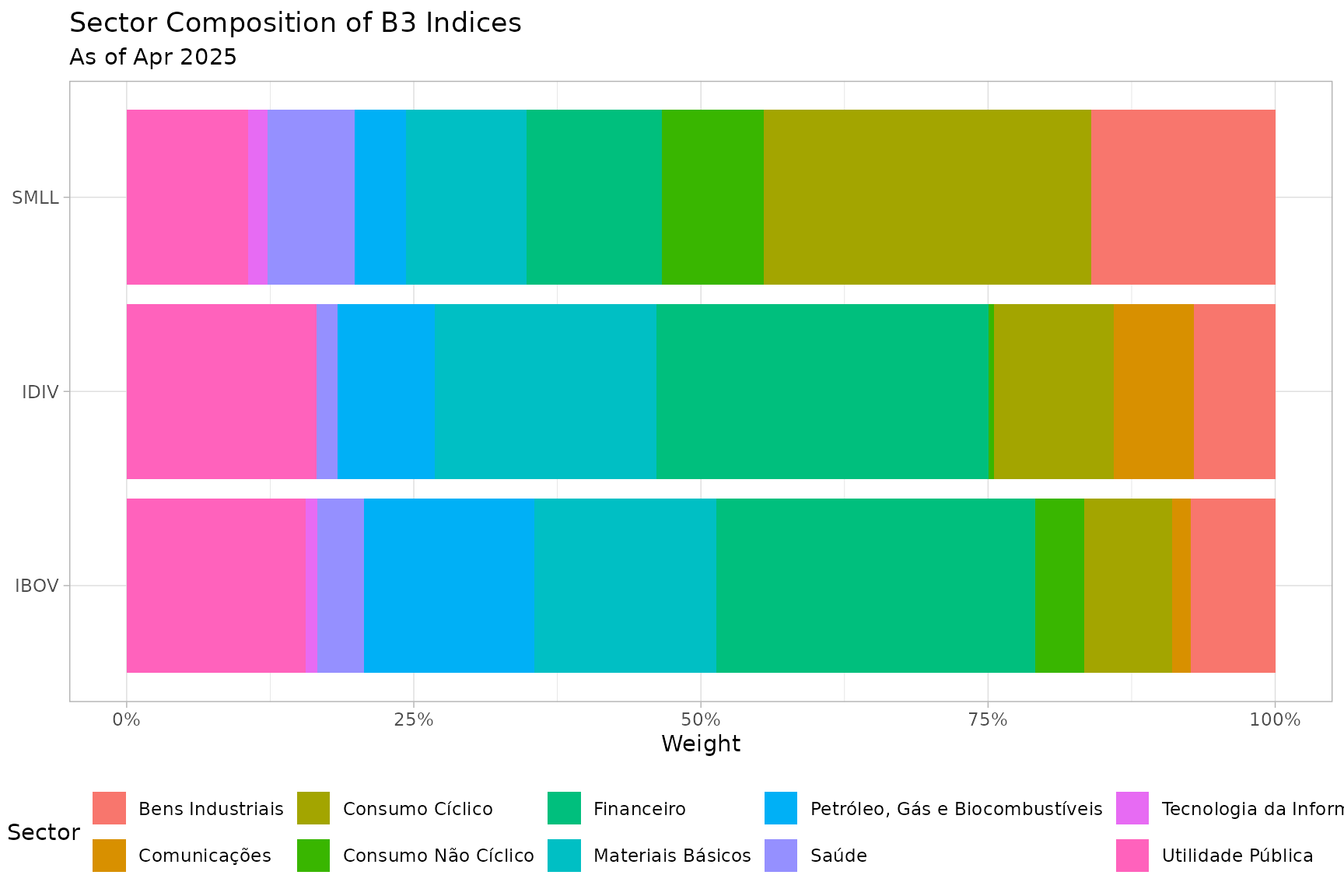

Sector analysis with the current portfolio

The b3-indexes-current-portfolio template provides the

actual current portfolio with additional sector classification:

# Download current portfolio data

fetch_marketdata("b3-indexes-current-portfolio", index = c("IBOV", "SMLL", "IDIV"))After downloading, you can retrieve the data:

# Get the current portfolio data

current <- indexes_current_portfolio_get() |>

collect()

# Get the latest date for each index

current_latest <- current |>

group_by(index) |>

summarise(latest = max(refdate))Sector composition analysis

You can analyze the sector composition of different indices:

# Create sector breakdown for each index

sector_data <- list()

for (idx in c("IBOV", "SMLL", "IDIV")) {

latest <- current_latest$latest[current_latest$index == idx]

sector_data[[idx]] <- current |>

filter(index == idx, refdate == latest) |>

group_by(sector) |>

summarise(weight = sum(weight)) |>

arrange(desc(weight)) |>

mutate(index = idx)

}

sector_df <- bind_rows(sector_data)

# Create a grouped bar chart for sector comparison

ggplot(sector_df, aes(x = index, y = weight, fill = sector)) +

geom_bar(stat = "identity") +

labs(

title = "Sector Composition of B3 Indices",

subtitle = paste("As of", format(max(current_latest$latest), "%b %Y")),

x = NULL,

y = "Weight",

fill = "Sector"

) +

theme_light() +

scale_y_continuous(labels = scales::percent) +

coord_flip() +

theme(legend.position = "bottom", legend.box = "horizontal")

Sector Breakdown of B3 Indices

This visualization shows how sector exposure varies across different indices, which is important for diversification analysis.

Creating helper functions for index analysis

You can create helper functions to streamline common tasks:

# Function to get assets in specific indices

indexes_assets_by_indexes <- function(index_list) {

last_date <- indexes_composition_get() |>

summarise(update_date = max(update_date)) |>

collect() |>

pull(update_date)

x <- lapply(index_list, function(idx) {

indexes_composition_get() |>

filter(update_date == last_date, str_detect(indexes, idx)) |>

select(symbol) |>

collect() |>

pull(symbol)

})

stats::setNames(x, index_list)

}

# Function to find which indices contain specific assets

indexes_indexes_by_assets <- function(symbols) {

last_date <- indexes_composition_get() |>

summarise(update_date = max(update_date)) |>

collect() |>

pull(update_date)

indexes_composition_get() |>

filter(update_date == last_date, symbol %in% symbols) |>

select(symbol, indexes) |>

collect() |>

mutate(

indexes_list = str_split(indexes, ",")

)

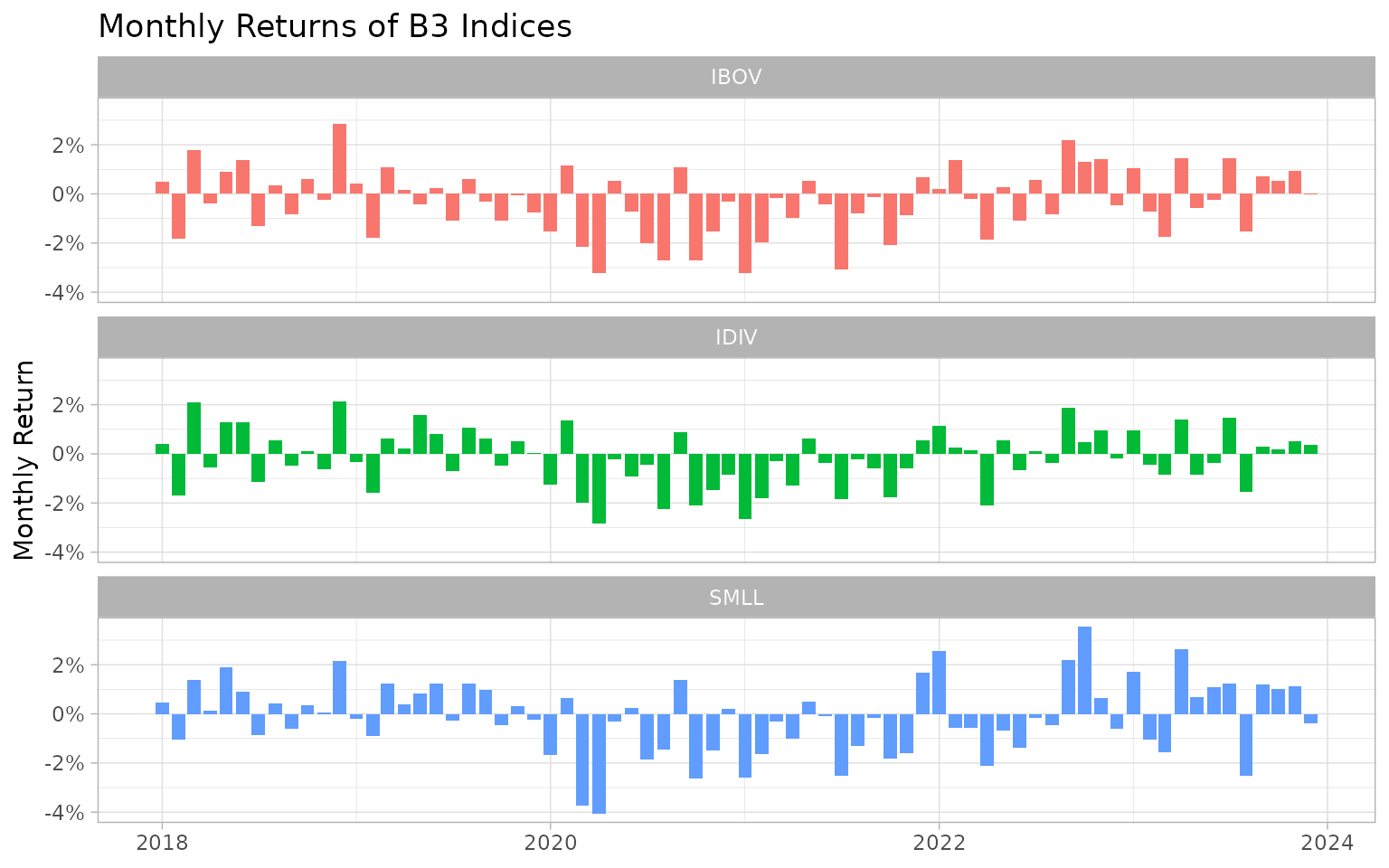

}Analyzing index performance metrics

You can calculate various performance metrics for the indices:

# Calculate monthly returns

monthly_returns <- index_history |>

group_by(symbol) |>

arrange(refdate) |>

mutate(

year_month = floor_date(refdate, "month"),

monthly_return = value / lag(value) - 1

) |>

filter(!is.na(monthly_return)) |>

group_by(symbol, year_month) |>

summarise(

monthly_return = last(monthly_return),

.groups = "drop"

)

# Visualize the monthly returns

ggplot(monthly_returns, aes(x = year_month, y = monthly_return, fill = symbol)) +

geom_bar(stat = "identity", position = "dodge") +

facet_wrap(~symbol, ncol = 1) +

labs(

title = "Monthly Returns of B3 Indices",

x = NULL,

y = "Monthly Return"

) +

theme_light() +

scale_y_continuous(labels = scales::percent) +

theme(legend.position = "none")

Monthly Returns of B3 Indices

Calculating summary statistics

You can calculate summary statistics to compare the performance of different indices:

# Calculate annualized summary statistics

performance_summary <- monthly_returns |>

group_by(symbol) |>

summarise(

Mean = mean(monthly_return, na.rm = TRUE),

Median = median(monthly_return, na.rm = TRUE),

Std.Dev = sd(monthly_return, na.rm = TRUE),

Min = min(monthly_return, na.rm = TRUE),

Max = max(monthly_return, na.rm = TRUE),

Positive = mean(monthly_return > 0, na.rm = TRUE)

) |>

mutate(

Annualized.Return = (1 + Mean)^12 - 1,

Annualized.Volatility = Std.Dev * sqrt(12),

Sharpe = Annualized.Return / Annualized.Volatility

)

# Display the summary statistics

performance_summary |>

select(symbol, Annualized.Return, Annualized.Volatility, Sharpe, Positive) |>

mutate(

Annualized.Return = scales::percent(Annualized.Return, accuracy = 0.01),

Annualized.Volatility = scales::percent(Annualized.Volatility, accuracy = 0.01),

Sharpe = round(Sharpe, 2),

Positive = scales::percent(Positive, accuracy = 0.1)

) |>

rename(

Index = symbol,

`Ann. Return` = Annualized.Return,

`Ann. Volatility` = Annualized.Volatility,

`Sharpe Ratio` = Sharpe,

`% Positive Months` = Positive

)

#> # A tibble: 3 × 5

#> Index `Ann. Return` `Ann. Volatility` `Sharpe Ratio` `% Positive Months`

#> <chr> <chr> <chr> <dbl> <chr>

#> 1 IBOV -3.54% 4.60% -0.77 41.7%

#> 2 IDIV -2.18% 4.01% -0.55 47.2%

#> 3 SMLL -1.45% 5.17% -0.28 47.2%Conclusion

This vignette demonstrated how to work with B3 index data using the

rb3 package. We covered:

-

Retrieving Available Indices: Using

indexes_get()to list all available B3 indices. -

Historical Performance Analysis: Using

b3-indexes-historical-datato analyze and visualize index performance over time. -

Index Composition Analysis: Using

b3-indexes-compositionto understand which stocks belong to each index. -

Portfolio Weight Analysis: Using

b3-indexes-theoretical-portfolioto analyze the weights and concentration of indices. -

Sector Exposure Analysis: Using

b3-indexes-current-portfolioto analyze sector allocation within indices. - Performance Metrics: Calculating and comparing performance statistics across different indices.

The combination of these four templates provides a comprehensive toolkit for analyzing the Brazilian equity market through its indices, suitable for investors, researchers, and analysts.

For more advanced analyses, you might consider:

- Tracking changes in index composition over time

- Building factor models using index constituents

- Creating custom indices based on specific criteria

- Analyzing the relationship between index performance and macroeconomic variables

- Constructing optimized portfolios based on index data